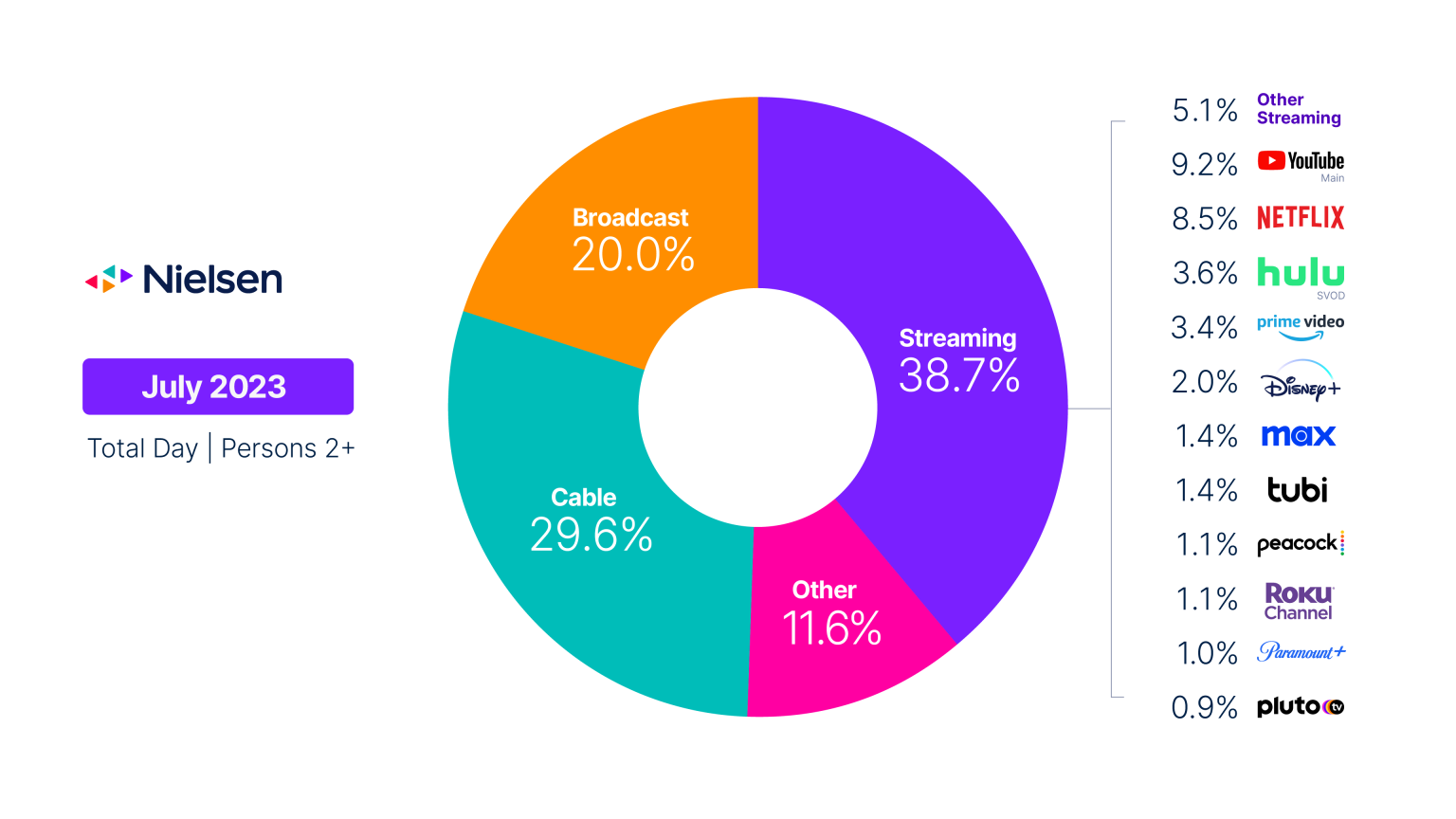

I cut the cord in 2008 and haven’t looked back. And it seems like many other consumers have done the same. This month, cable and broadcast channels dipped below 50 percent of U.S. viewers for the first time according to Nielsen. It’s a practical and symbolic loss for linear TV and a big win for streaming.

Going deeper into the numbers, Nielsen’s July 2023 Report (scintillating title) quantifies cable’s market share at 29.6 percent, down 12.5 percent year-over-year. Broadcast TV meanwhile stands at 20 percent market share, down 5.4 percent year-over-year. That puts their collective share just shy of 50 percent.

Streaming correspondingly accounts for 38.7 percent of U.S. TV viewers, a record high for the category, up 25.3 percent year-over-year. This is driven by YouTube, Netflix, and Hulu at 9.2 percent, 8.5 percent, and 3.6 percent market share respectively. These shares show how fragmented the market is.

Familiar Story

Furthering the fragmentation is the growth in FAST. Standing for free ad-supported streaming TV, these OTT apps include Freevee, Pluto TV, Tubi, Roku Channel, and Crackle. These emerging options resonate in an economic downturn as households look for places to cut discretionary spending.

Making things bleaker for cable and broadcast, their collective decline (linear TV) has accelerated in the past few years. Specifically, Nielsen reports that linear TV’s 49.6 percent share today represents a rapid tumble from its 63.6 percent share in June 2021. This means its troubles aren’t slowing down.

But the big question is why? Partly driving this mass migration is an increasingly on-demand culture that diverges from years-long paradigms of appointment viewing. And part of it is the familiar story of legacy media, or any incumbent for that matter, failing to adapt despite countless warning signs.

On that last point, this is what has happened to newspapers, yellow pages, and other legacy-media subsets. To be fair, it’s hard to change course given such massive cruise ships – not to mention the well-known “trading analog dollars for digital pennies” cannibalization dilemma (a.k.a. innovator’s dilemma).

Classic Darwinism

But that’s about as forgiving as we’ll be towards cable and broadcast. On the cable side, natural monopolies bred complacency and failure to innovate. This caused the product itself to fall behind challengers like Netflix. And from a hardware perspective, don’t get me started on the cable-box UX.

Of course, price is a factor as the cable bundle has inflated over the past decade. But with increased supply in the streaming world – Peacock, Paramount+, Netflix, Max, Hulu, etc. – a multi-app household is paying almost as much ($87 on average says FT). That brings the driving factor back to quality.

So in the end, this is classic Darwinism. Netflix, Hulu, and Max are far superior to the cumbersome and infuriating programming grids and menu systems of your typical cable UX. Apple TV is more pleasantly designed than any cable box interface. Until that changes, cable and broadcast’s slide continues.