Data Scout is LSA’s series that curates and draws meaning from third-party data. Running semi-weekly, it adds an analytical layer to the industry data that we encounter in daily knowledge building. For Localogy original data, see the separate Modern Commerce Monitor™️ series.

Overall spending per company on SaaS applications was up 50% in 2019. Yet the number of unique applications per company rose by 30%. These and other interesting stats about SaaS usage at small, medium and enterprise companies appear in Blissfully‘s new “2020 SaaS Trends Report.”

Blissfully offers a SaaS management tool that helps companies track their SaaS subscriptions and save money by canceling duplicate or dormant subscriptions. So many of the numbers the report shares are designed to reinforce the point that many companies are using SaaS inefficiently, and therefore support the notion that products like theirs are necessary.

That said, the report includes interesting nuggets that shed light on trends in the SaaS world.

The study looked at 1,000 companies across small (100 or fewer employees), mid-size (101-1,000 employees) and enterprise (1,000 plus).

Highlights of the 2020 SaaS Trends Report

- As noted, overall spending on SaaS subscriptions per company grew by 50% from 2018 to 2019 while unique apps per company rose by 30%. That spending rose faster than the apps per company suggests companies were upgrading or adding service plans to their existing apps. It’s also worth noting that the 50% spending increase, while impressive, represents a slowing rate of growth.

- The average number of apps per company was 137, with 102 for small businesses, 185 for mid-range companies, and 288 for enterprises.

- Companies churn out about 30% of their SaaS apps each year.

- The number of duplicate app subscriptions per company rose by 80% in 2019. The average number of duplicate apps per company was 3.6. Among enterprise businesses, the figure was 7.6, while small businesses had just 2.3 duplicate apps on average.

- Orphaned subscriptions spiked by 100% last year. The report noted that both duplicate nad orphaned apps pose security risks.

IT and CX Lead the Way

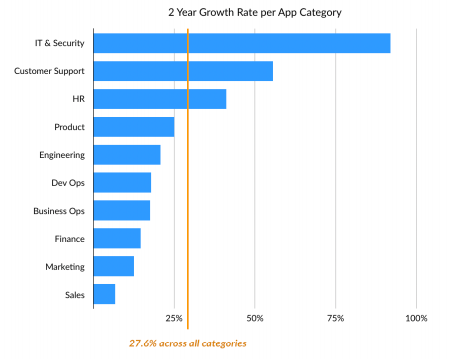

The Blissfully report shows that growth in SaaS adoption varied significantly by the organizational department. Apps for IT and security, servicing customers or managing staff outperformed the average growth rate, as the chart below shows. Sales and marketing apps had the slowest growth rates.

The slow growth of sales and marketing apps reflects their early adoption and the later adoption of other services. Another factor at play may be the growing importance of privacy and data security and delivering high-quality customer experience.